DID YOU KNOW THAT LATE RENEWAL OF BUSINESS REGISTRATIONS CAN RESULT IN PENALTIES INCLUDING CONFISCATION OF ASSETS AND EVEN IMPRISONMENT1?

A business permit is a license necessary for all businesses to operate legally in the Philippines2. This is a requirement before a business begins its operations and is valid only for the year it was applied for. Thus, it must be renewed annually. Traditionally, business permits must be renewed by January 20 of every year. As such, the first month of every year is a critical period for all business owners. Operating with an expired business permit may subject you and your business to a (1) Closure Order, (2) fines amounting to twenty-five percent (25%) of the taxes/fees not paid on time and an interest rate of a maximum of two percent (2%) per month of non-payment3, (3) confiscation of assets and other penalties prescribed by your Local Government Unit (LGU).

This year, several LGUs have extended their deadline for the application for renewal of business permits without surcharges and penalties. Among these LGUs are:

- Makati City – 31 January 2023

- Muntinlupa City – 31 January 2023

- Cebu City – 31 January 2023

- Marikina City – 31 March 2023

Another registration that is required annually is the registration with the Bureau of Internal Revenue (BIR) which is due on January 31 of every year. This is a yearly tax filing requirement for all businesses which, if not done, will result in a penalty of a fine of not more than One Thousand Pesos (Php1,000.00) or imprisonment of not more than six (6) months4.

The application for renewal commonly requires one to secure several documents and information, compile the requirements and process the same manually by going to the Local Government Unit (LGU) office in person. While some LGUs have launched online platforms, the majority of LGUs still mandate the filing to be done physically. The following sections will summarize the most common requirements to be prepared for each application.

HOW CAN I RENEW MY BARANGAY BUSINESS CLEARANCE?

Business Permit Renewal typically begins with the application of a Barangay Business Clearance with the Barangay Hall having territorial jurisdiction over the registered address of the business. Present the original and a photocopy of all requirements to the Barangay Hall. Each Barangay may have its own variations on the specific requirements; however, these are the most common requirements:

- Application Form

- Barangay Business Permit for the previous year

- Official Receipt for the previous year

- Latest Cedula or Community Tax Certificate

- Payment of Fee

The processing time for this varies from LGU to LGU which usually ranges from one (1) day to one (1) week. Also, note that the closer to the deadline for renewal of the application is, the longer the lines are which may equate to a longer processing time for the permit.

WHAT SHOULD I BRING FOR MY MAYOR’S PERMIT RENEWAL?

After the issuance of the Barangay Business Clearance, one can begin applying for the renewal of the Business Permit from the Mayor’s Office. Unless exempt, registered businesses in the Philippines must renew their respective business permits each year within their local Municipality or City hall. The most common requirements for the application for business permit renewal are as follows:

- Application Form

- Barangay Business Clearance for the Current year

- Mayor’s Permit for the previous year

- Official Receipt for the Mayor’s Permit for the previous year

- Audited Financial Statement /Income Tax Return/Monthly or quarterly Value Added Tax Returns or Affidavit of No Operations, if your business did not operate in the previous year

- Notarized Contract of Lease if renting

- Comprehensive General Liability Insurance

- Community Tax Certificate/Cedula

- Payment of Fees (Local Business Tax, Mayor’s Permit Fee, Sanitary Inspection Fee, and other fees as may be imposed by your LGU)

Check with your local Municipality or City the specific requirements and verify any additional requirements which may be required by reason of the nature of your business

The application for business permit renewal must be submitted on or before 20 January of each year. The deadline applies notwithstanding the date of your business registration with Department of Trade and Industry (DTI) or Securities and Exchange Commission (SEC).

Upon submission of the complete requirements to your local Municipality or City Hall, the processing time for the issuance of the permit ranges from one (1) week to two (2) weeks depending on the LGU.

HOW CAN I PAY THE ANNUAL BIR REGISTRATION FEE TO AVOID PENALTIES?

The last leg for the renewal is the renewal of the registration with the BIR. Yes, you need to renew your BIR registration annually. All businesses are required to pay the Php500.00 Annual Registration Fee (ARF) on or before 31 January of each year5.

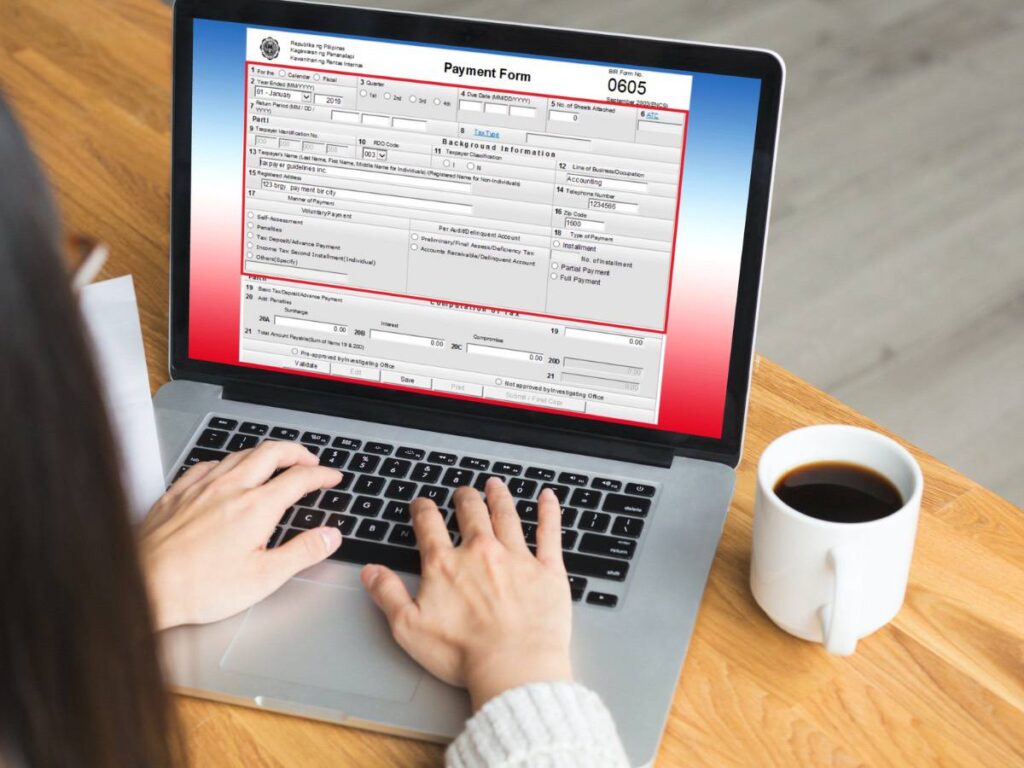

To apply for BIR registration renewal, you can prepare BIR Form No. 0605 using the Electronic BIR Forms (eBIRForms) Package6. Fill in your BIR registration details based on your Certificate of Registration and submit the validated form. You should be able to receive an email notification from the BIR that the return has been received.

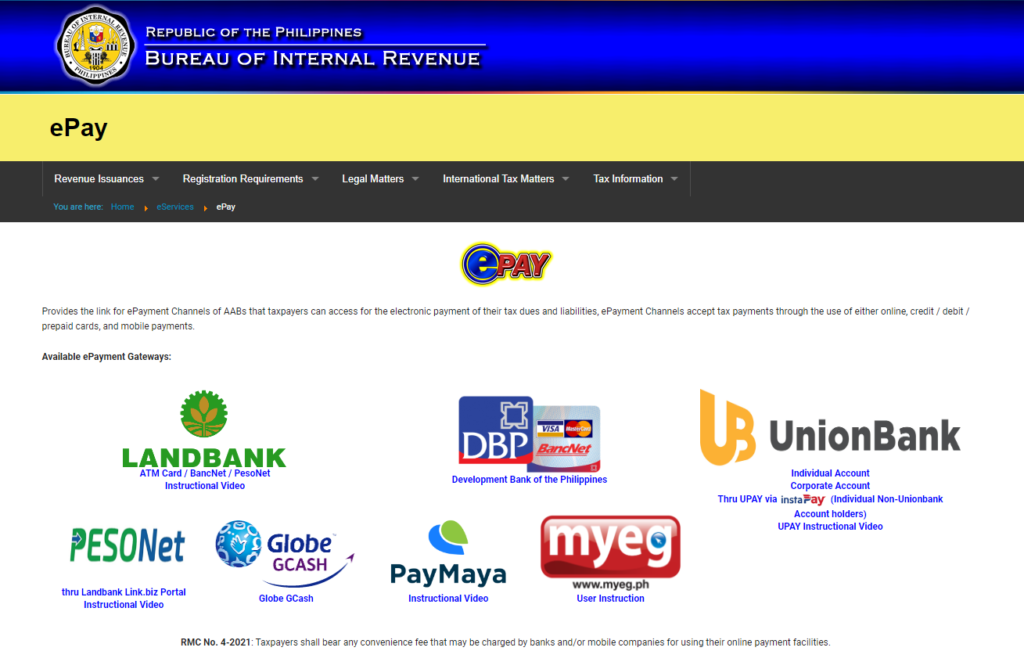

Finally, you can now pay the ARF of Php500.00 in an authorized bank or via any online facilities such as GCASH, Paymaya, DBPPay, Peso Net, Landbank, and Unionbank.7

Once the BIR Form No. 0605 has been filed and paid, it must be displayed in the business establishment or office premises together with other business licenses and permits.

Indeed, the filing for the renewal of business permits and registrations can be quite tedious and lengthy. But keep in mind that operating without legal permits could lead to closure of business, fines, and even imprisonment. Should you need guidance and/or assistance in renewing your business permits and registrations, or even applications for new business registrations, you may contact us for help.

Prepared and written by Aira Montemayor and Gerwin Ortega.

FOOTNOTES

- Disclaimer: The penalties vary from one LGU to another.

- Local Government Code, Sections 444(b)(3)(iv) and 455(b)(3)(iv)

- Local Government Code, Section 168.

- Revenue Memorandum Order (RMO) No. 7-2015 Annex A and National Internal Revenue Code, Section 275.

- National Internal Revenue Code, Sec. 236(B).

- Bureau of Internal Revenue, Electronic BIR Forms https://www.bir.gov.ph/index.php/eservices/ebirforms.html

- Bureau of Internal Revenue, ePay https://www.bir.gov.ph/index.php/eservices/epay.html