Business closure in the Philippines entails the need to secure clearances from different government agencies, including the Securities and Exchange Commission (SEC), Bureau of Internal Revenue (BIR), Local Government Unit (LGU), and other regulatory agencies such as DOLE, SSS, PhilHealth, and Pag-IBIG.

Never assume that non-operation will automatically relieve an owner from regulatory compliance because failure to properly close a business can result in penalties for unprocessed tax filings, business permits and licenses, reportorial requirements, mandatory contributions, etc. Worse, it can expose the owners to potential lawsuits!

So if you ever find the need to close your business, here’s a quick guide to help you with the entire process.

Q: Where do I go to officially close my business?

The process of officially closing a business in the Philippines involves many government agencies, including: SEC, BIR, LGU, and DOLE/SSS/PhilHealth/Pag-IBIG.

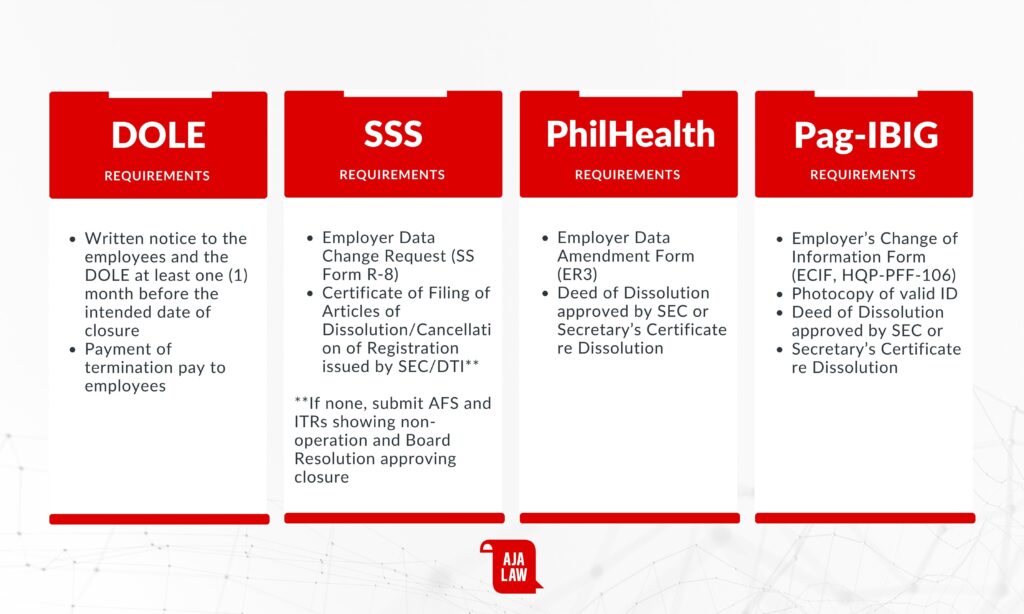

Q: HOW DO I CLOSE MY BUSINESS WITH THE DOLE/SSS/PHILHEALTH/PAG-IBIG?

You have to first give a written notice to your employees and DOLE at least one month prior to the intended date of closure.

Next, you must notify SSS, PhilHealth, and Pag-IBIG of the closure to stop the company’s obligations as a contributing employer.

Here are the usual requirements:

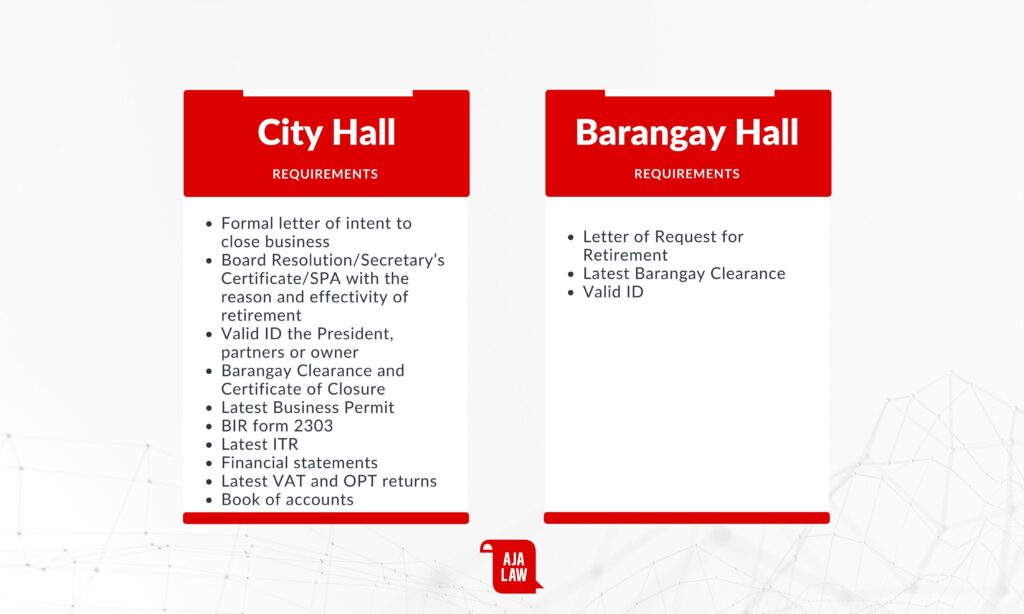

Q: What is the process in LGU and what do I bring?

You have to start by submitting your requirements to the Barangay Hall of your business location. After paying the fees, await the release of your Barangay Clearance and Certificate of Closure.

The next step is to head to the City Hall of your business location to submit the requirements, pay the fees, and await the release of your Certificate of Closure.

Here are the usual requirements:

Note that procedure and requirements among LGUs may vary so be sure to confirm with your LGU first.

Without proper business closure, a company will have to continue securing its annual permits and ancillary clearances. Failure to do so will result to penalties prescribed by these LGUs.

Q: What is the process in BIR and what do I bring?

This is more challenging. There are more requirements and the process is much longer with the BIR, but you have to go through it regardless to avoid open cases and legally stop filing tax returns.

Note that the penalty for unfiled NIL tax returns could reach up to P25,000/calendar year in addition to any tax deficiency if any. These open cases do not prescribe and will continue to accumulate until settled.

Revenue Memorandum Circular No. 57-20201 prescribes the updated policy and revised checklist of documentary requirements for business closure and TIN cancellation in the BIR.

To start, you have to bring your requirements to the regional district office (RDO) of the place where your business is located and to apply for the cancellation of your business TIN. After obtaining clearance from all section of the RDO, BIR will conduct a tax audit on your operations to identify any unsettled open cases and tax liabilities. Should there be any tax deficiencies found, you have to settle them and pay for the closure fees before you can claim your Tax Clearance Certificate.

Here are the usual requirements:

- Request-letter for business closure BIR Form 1905

- List of ending inventory of goods, supplies, including capital good

- Inventory of unused official receipts and sales invoices

- Unused sales invoices/official receipts and all other accounting forms (These will destroyed before BIR personnel and officials.)

For those transacting through a representative:

- Board Resolution or Secretary’s Certificate

- SPA

After securing the Tax Clearance Certificate, you can now head to SEC or DTI depending on what business organization you are.

Q: What is the process in DTI and what do I bring?

Sole proprietorships can head to DTI to cancel their business name in a few easy steps: submit requirements, pay fees and claim Certificate of Cancellation.

The usual requirements include:

- BN-Related Application Form

- One (1) Valid ID of the BNR owner

- Affidavit of Cancellation that BNR owner gave notice, has no intent to defraud creditors or subsisting financial obligation.

- SPA/Board Resolution for representatives

Q: What is the process in SEC and what do I bring?

Corporations and partnerships can then apply with SEC to get a Certificate of Dissolution.

SEC Memorandum Circular No. 5, Series of 20222 provides for the revised guidelines on corporate dissolution. The process and requirements vary depending on the mode of dissolution. Generally, the process can be summarized in a few steps:

- Secure clearance/s from other regulatory agencies of the business (i.e. FDA, PEZA, BOI etc.)

- Submit the requirements and follow up status

- Pay the assessment

- Claim Certificate of Dissolution

Note that SEC MC No. 5 also allows Dissolution by Shortening Corporate Term pursuant to Section 136 of the Revised Corporation Code. Here, the company’s Articles of Incorporation is amended to reflect the date of the shortened term and upon its expiration, the corporation is deemed dissolved.

In sum, the main requirements are:

If you wish to consult our experienced team and save on potential lawsuits and issues, feel free to contact us at info@aja.law.

Prepared and written by Jann Mahinay.