In a significant move to streamline tax procedures and reduce the burden on taxpayers, the Philippine government has enacted a series of amendments to the National Internal Revenue Code (NIRC) through the Ease of Paying Taxes Act (“EOPT Act”). This legislation was signed into law on 07 January 2024 and effective as of 22 January 2024.

The EOPT Act introduced a number of changes designed to simplify the tax system, making compliance more accessible and manageable for individuals and businesses alike. In the following sections, we explore the principal amendments and their implications on tax compliance and administration.

Abolishment of the Annual Registration Fee

Previously, all registered taxpayers were required to pay an annual registration fee of Five Hundred Pesos (Php500.00) pursuant to Section 236 of the NIRC due before the last day of every January. This has since been repealed by the EOPT Act alleviating the financial burden and lessening the annual registration that businesses handle at the beginning of every year.

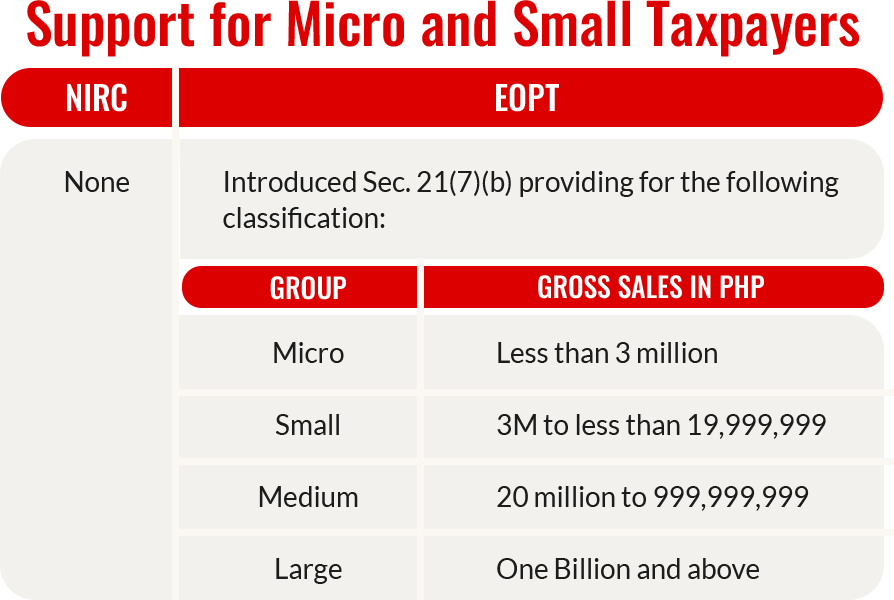

Classification of Taxpayers and Support for Micro and Small Taxpayers

The EOPT Act introduced a classification of taxpayers based on gross sales into micro (less than 3 million), small (3M to 19,999,999), medium (20M to 999,999,999) and large (1B and above).

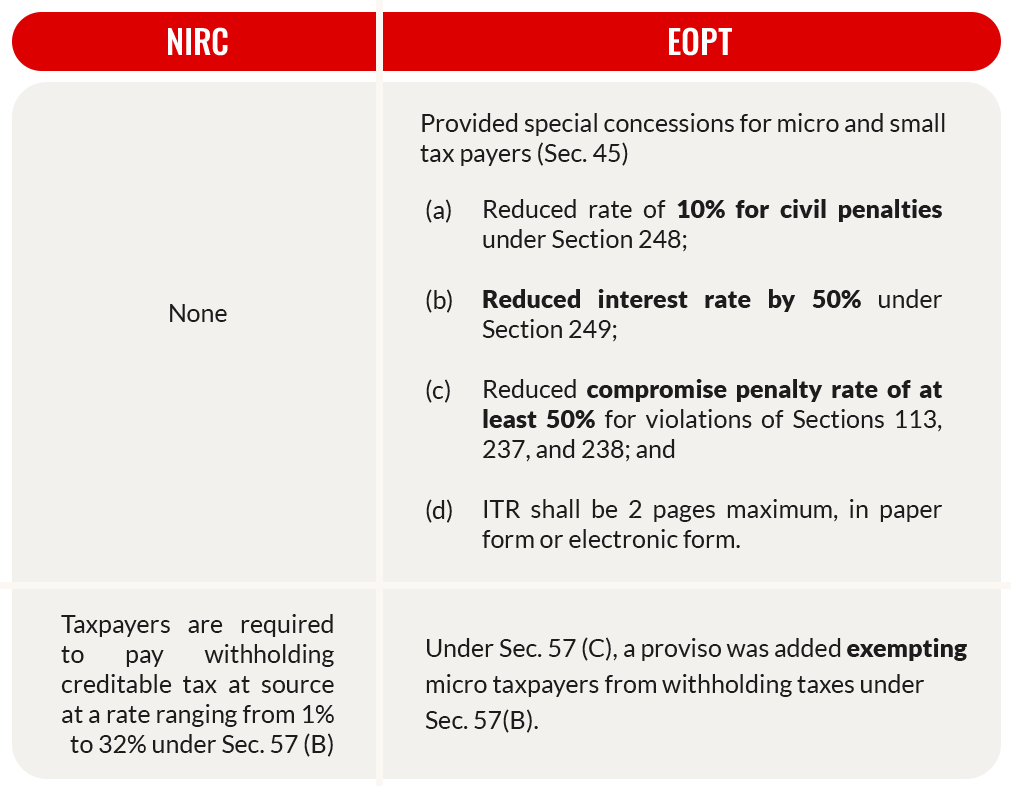

Micro and small taxpayers are granted the following concessions, among others,:

- The penalty of 25% for the failure to file return and pay any taxes, including deficiency taxes was reduced to 10%;

- The interest on any unpaid amount of tax set at double the legal interest rate (i.e. 12%) has been reduced to half or the legal interest rate (i.e. 6%)

- The penalties for issuing erroneous VAT Invoice, non-issuance of VAT Invoice and incomplete details on VAT invoice has been reduced to at least 50%.

Furthermore, micro taxpayers shall not be required to withhold creditable taxes at sources under Subsection (B) of Section 57.

The aforementioned concessions reduce the administrative burden on tax compliance on smaller businesses.

Electronic and Manual Filing and Payment of Taxes

Among the revisions found throughout the EOPT Act is the amendment of the provisions pertaining to the internal revenue taxes and the insertion of the words “either electronically or manually” following every instance of the words “pay” or “file”. (Secs. 51(D), 56, 58, 77, 81, 90, 91, 91 (D), 103, 114, 116, 128 (A) and (B), 200, 236, (C), (E), (G), (H), 237, 238, 241, 245)

This amendment was likewise followed by the place of filing or payment which is now ANY authorized agent bank, Revenue District Officer through Revenue Collection Officer, or authorized tax software provider.

This modification significantly makes tax compliance more accessible and flexible. This is likewise a significant step toward the digitalization of the Bureau of Internal Revenue prescribed under the EOPT Act.

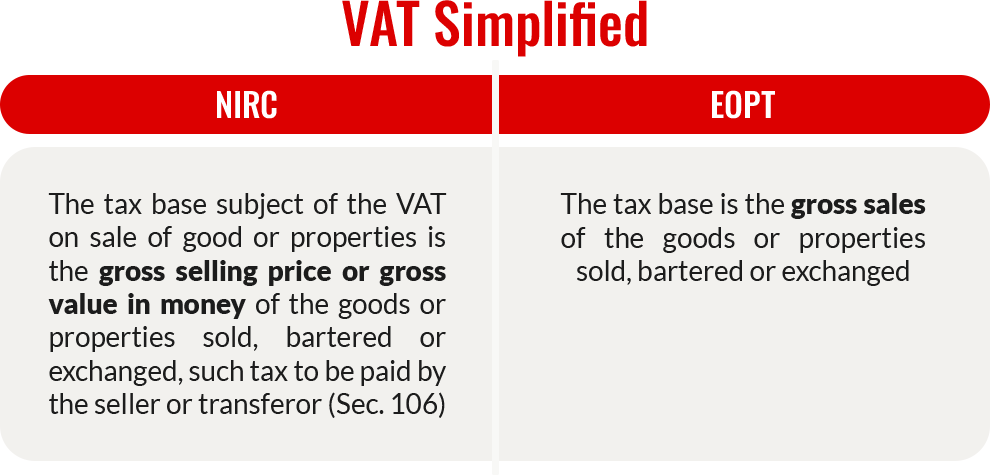

Value Added Taxes

The EOPT Act introduced several amendments to VAT compliance. These amendments refer to the following:

- The tax base for VAT was amended from “gross selling price” to “gross sales”.

- VAT-registered persons are now allowed to deduct the value of services for which allowances were granted from the gross sales in the quarter a refund, credit memorandum, or refund is issued, and also permits the exclusion of sales discounts shown on the invoice at the time of sale from the gross sales of the same quarter, provided these discounts are unconditional.

- The sale or lease of goods or services that not exceeding the gross annual sales of Three Million Pesos (Php3,000,000.00) are now considered as exempt transactions;

- Output VAT related to uncollected receivables may be deducted from its output VAT on the next quarter provided that the VAT on the transaction was fully paid and the same has not been claimed as an allowable deduction;

- Business style of the purchaser, customer or client is no longer required to be contained in the VAT invoice, while Issuance of a VAT invoice with lacking information shall be penalized.

- VAT registered persons must issue invoices regardless of the amount.

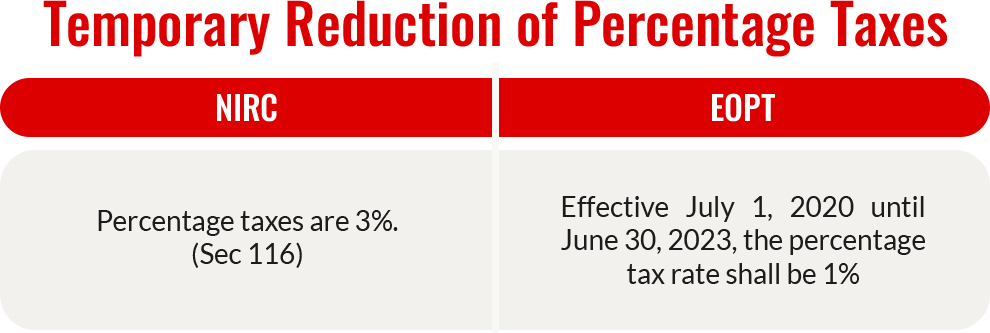

Percentage Taxes

Percentage taxes between 01 July 2020 until 30 June 2023, were reduced to a rate of one percent (1%) instead of three percent (3%).

Moreover, the tax base for tax on overseas dispatch, message or conversation transmitted from the Philippines is the billed amount for such services rather than the actual payments received. Following this, exemptions for taxes for overseas dispatch, message or conversations are likewise based on amounts billed.

Application for Refund or Tax Credit

In general, the EOPT Act prescribes that credit or refund of taxes erroneously or illegally received or penalties imposed without authority shall be decided by the Commissioner within 180 days. Further, the two-year prescription period under Section 229 for the filing of suits has been removed. Finally, the EOPT stipulates that should there be a denial or lack of response within the 180-day period, one must proceed by appealing to the Court of Tax Appeals within 30 days. These amendments give the taxpayer a clear timeframe and course of action for the resolution of its claim thereby reducing the uncertainty and financial burden during such disputes and an extended period to avail of other legal remedies.

Other notable revisions to the refund or tax credit application processes are as follows:

Taxes withheld at source

For taxes withheld at source, the EOPT Act prescribes that the deduction must arise at the time the income has become payable.

Furthermore, claims for tax credit shall be given due course only when two conditions have been met (1) it is shown that the income payment has been declared as part of the gross income; and (2) the fact of withholding is established. Claims for tax credit is creditable in the subsequent calendar or fiscal year provided that it has been declared in the tax return where the income is reported.

Income Tax

Application for refund for income tax credit that cannot be carried over due to dissolution or cessation of business shall be decided by the BIR within 2 years from date of dissolution or cessation of business.

VAT

Businesses who have cancelled registrations due to business cessation are allowed, in addition to using the unused input tax as payment of other internal revenue taxes, to apply for a tax refund for any unused input tax within two (2) years from the date of cancellation

Further to this, all VAT refund claims are now subject to a risk-based classification (low, medium, high) based on several factors such as amount of VAT refund claim, tax compliance history, and frequency of filing VAT refund claims. Medium and High-risk claims shall be subject to audit for the relevant year. Should the Commissioner fail to act on a refund application within ninety (90) days, the EOPT Act allows a taxpayer to file an appeal.

The following portion shows a matric that outlines the key changes brought about by the EOPT Act in relation to tax refunds:

| NIRC | EOPT |

| None | A tax credit or refund for withheld creditable income tax will be given due course when the income has been included in gross income and withholding is proven. – Tax credits for income tax withheld in a previous period are permissible in the next calendar or fiscal year if reported on the tax return where the income is reported. |

| None | In cases where a business cannot carry over an excess income tax credit because of dissolution or cessation, a refund application must be filed. – The BIR obligated to process this refund application and issue any excess refund within 2 years from the date of the business’s cessation. (Sec. 76) |

| None | VAT refund claims will be categorized as low, medium, or high risk based on factors such as the claim amount, the taxpayer’s compliance history, and the frequency of refund claims. – Medium and high risk claims are subject to an audit or verification. (Sec. 112) |

Other Compliance requirements

- Overseas Contract Workers and Overseas Filipino Workers are no longer required to file an income tax return.

- Books of Accounts and Other Accounting Records must be kept for five (5) years instead of the initial three (3) years prescribed by the NIRC.

- Threshold for issuance of sale or commercial invoices, except for VAT registered persons, increased from Php100 to Php500, subject to adjustment every three years.

| NIRC | EOPT |

| Sec. 51 (A) (2) The following individuals shall not be required to file an income tax return: x x x | “Overseas Contract Worker”, or “Overseas Filipino Worker”, are expressly not requiredto file an income tax return |

| Books of account and accounting records shall be preserved from the last entry until three years, either from the legally fixed period for filing the tax return or from the actual filing date, whichever is later. (Sec 235) | Books of account and accounting records must be preserved for 5 years from the date of filing of the return for the taxable year of the last entry. |

| The threshold for issuing commercial invoice is Php100. (Sec 237) | The threshold for issuing commercial invoice is now Php500.00. |

As we wrap up our overview of the Ease of Paying Taxes Act, it is clear that these reforms are poised to make a substantial impact on individuals and/or businesses’ tax compliance. By abolishing outdated fees, simplifying VAT processes, and introducing more flexible filing options, the EOPT Act aims to foster a more inclusive and streamlined fiscal environment. Whether you’re a small business owner grappling with VAT or a large corporation navigating complex tax landscapes, the changes brought about by this legislation are designed to support and simplify your tax obligations.

Embrace these changes with an informed perspective and consider how you can leverage the new provisions to enhance your tax planning and compliance strategies. As always, staying ahead of tax legislation not only ensures compliance but can also significantly optimize your financial planning. Should you need some more advice on these matters, feel free to contact our team.

Prepared and written by Aira Montemayor.